Press information – Economy / Finance/ Crypto Assets

June 1st, 2021

© Blockpit

Blockpit launches Cryptotax in Spain

A software to simplify the tax declaration of cryptocurrencies and other digital assets.

- With Cryptotax, investors in cryptocurrencies will be able to obtain their tax reports quickly and easily to include them in their income tax declaration

- More than 7.5 million Spaniards have already entered the crypto space and most of them (60%) use cryptocurrencies as a financial investment

Madrid, June 1, 2021 – Blockpit, a leading company in the development of financial compliance solutions, has launched Cryptotax in Spain, its crypto tax reporting and monitoring tool that allows you to easily generate tax reports. Last year, the digital asset market experienced a high growth, therefore, all those investors who obtained benefits through transactions with digital assets must include them in the income tax declaration this year. They have until June 30 to do so. Digital asset tax debt is not automatically calculated, reported and deducted to tax authorities, thus there is a risk of unconscious tax evasion.

The year 2020 has seen the most significant annual growth in the number of cryptocurrencies, which rose to more than 4,000 by the end of the year, according to data from CoinMarketCap. More than 7.5 million Spaniards have entered the crypto space and most of them (60%) use cryptocurrencies as a financial investment, according to IE University. Since the beginning of 2021 and with the strong increase in the cryptocurrency market, the company has achieved a growth of the user base in Spain of more than 1,300%. Due to the growth of this market, Spain has approved the draft Law on the prevention and fight against tax fraud, a measure that obliges those who custody third-party cryptocurrencies to report the ownership and the transactions carried out with them, among others modifications in the tax area.

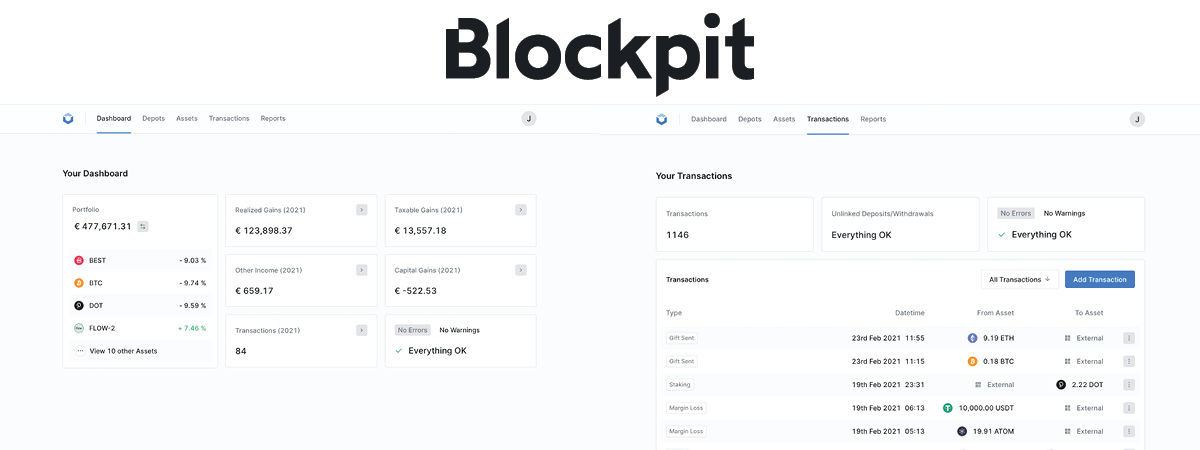

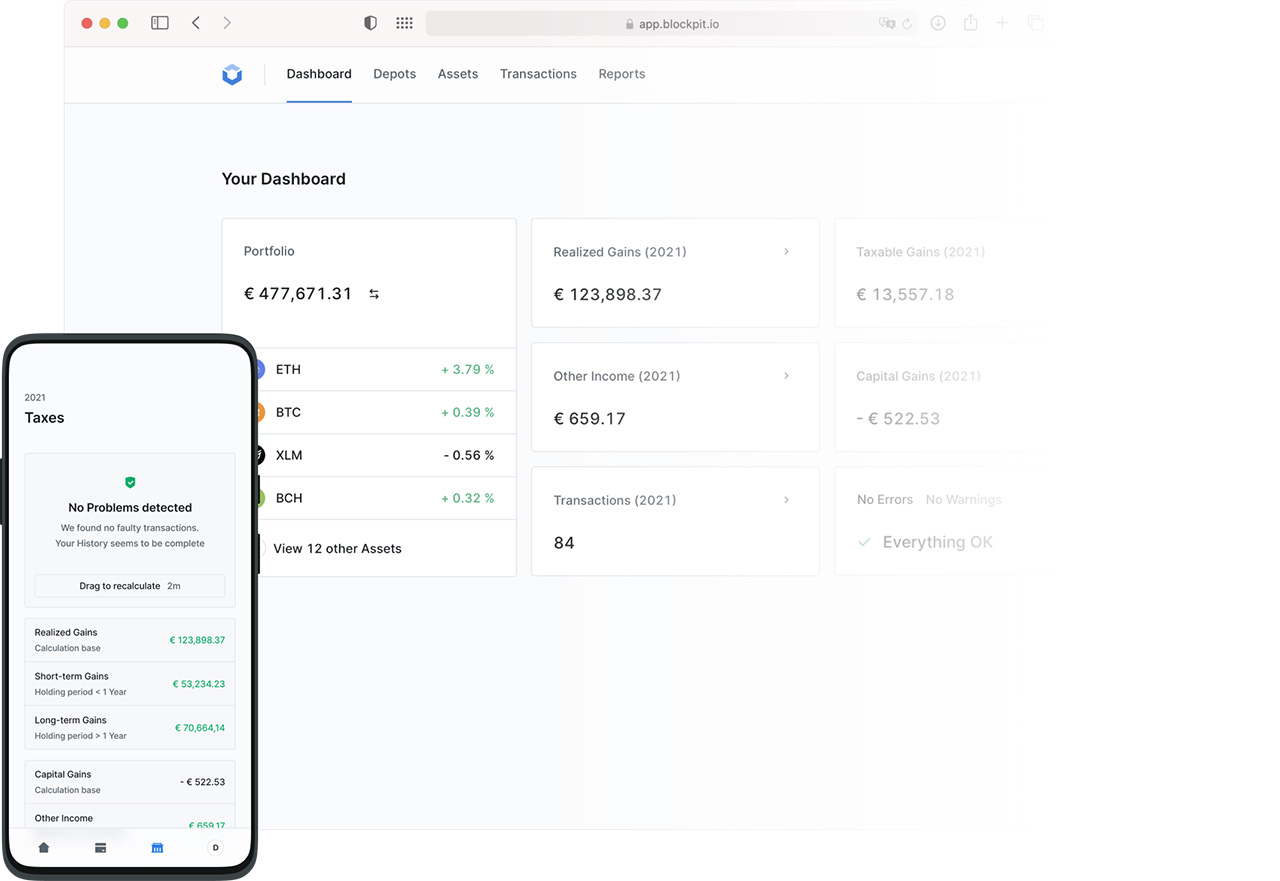

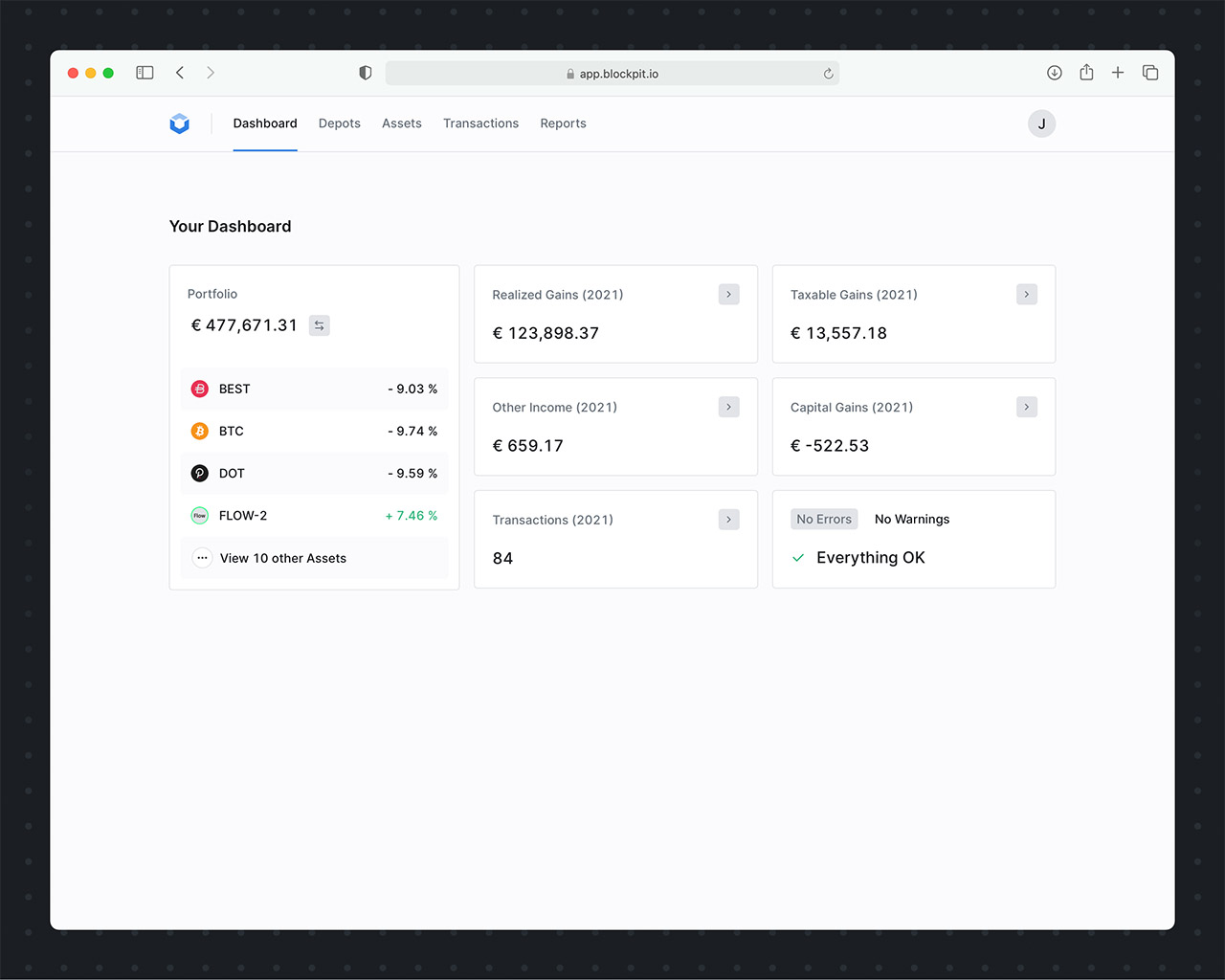

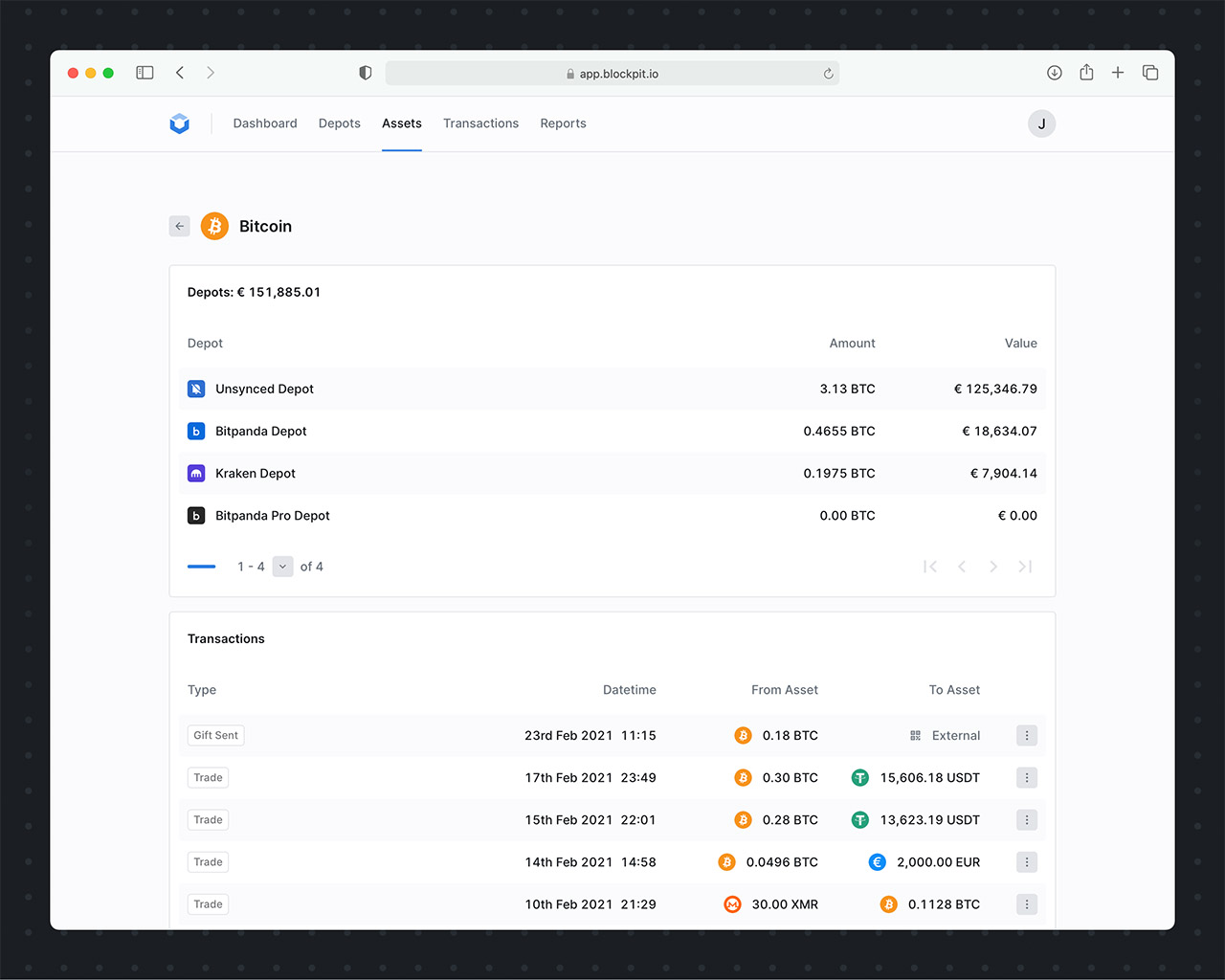

Cryptotax is a tax calculation software that allows importing transaction data from major cryptocurrency exchanges and personal wallets and analyzes them automatically, so that the user can obtain their tax report with all the information necessary for the Tax Agency with a single click. Cryptotax, which offers its free version for up to 25 operations per year, evaluates data anonymously and in read-only mode (whether you are trading, mining, staking or simply holding a long-term investment, the tax conditions will vary). The resulting tax report is optimized for taxes and the calculation algorithm is audited by one of the big four auditing firms.

“Especially in times of high volatility, the tax aspect plays a crucial role in all investment decisions. We want to offer a solution for all investors to document their transactions transparently at the push of a button, help traders make optimal tax decisions and avoid serious consequences for potential tax evasion. A complete documentation of all the transactions carried out can and will be requested by the Tax Agency” states Florian Wimmer, CEO and co-founder of Blockpit.

Both gains and losses resulting from operations with cryptocurrencies, whether obtained through exchange for other assets or by providing a good or service in exchange for cryptocurrencies, must be included in the annual income tax return. Another dangerous category includes gifts and prizes like Airdrops or Rewards. These are capital gains for which no cost has been incurred. Gains or losses of this type should also be included in the general tax base of the income tax, along with the rest of the income that makes up the tax base”, warns Florian Wimmer.

Currently, many investors in crypto assets are unaware of their tax obligation and that they are, therefore, responsible for declaring and paying taxes associated with digital assets. In the worst case, they could be charged with tax evasion with heavy penalties. “Any exchange made, whether from crypto to legal currency money or from crypto to crypto, is a taxable event according to current Spanish legislation. Taxable profit or loss will be the difference between the asset’s acquisition cost and its market value at the time of sale”, says Wimmer. For this reason, many operations carried out previously may have led to decisions that were not optimized from a tax perspective or even unconsciously caused tax evasion.

### END ###

About Blockpit

Blockpit, founded in 2017 in Austria, is a leading company in the development of financial compliance solutions for portfolio management and tax reporting on transactions with crypto assets based on blockchain technology. Both individuals and corporations benefit from tax compliance solutions that are permanently audited by one of the big four accounting firms. As of today, Blockpit offers its tax reporting services in Spain, France, Germany, Switzerland, Austria and the United States of America, serving as a bridge between traders, tax advisers, institutions and the Tax Authority. Additional information at www.blockpit.io

Any questions?

Spanish press release:

PRGarage (ES/EN)

Carlos Hergueta

(+34) 619 55 99 91

(+34) 91 137 52 98

carlos@prgarage.es

www.prgarage.es

Blockpit general (DE/EN)

Mag. Karol Walter Nuhn

skyrocketX | Media Relations e.U.

+43 650 525 42 12

karol@skyrocketx.com

www.skyrocketx.com

Credits

All images © Blockpit

Publication, duplication and printing of the text and picture material sent with the report in the course of their reporting are permitted without restrictions. We ask for consideration of any picture credits. The rights of use of the material sent with the report are valid for an unlimited period of time.

DOWNLOAD RELEASE

IMAGE MATERIAL

Copyright info

All images © Blockpit

Publication, duplication, printing and adaptions of the text and picture material sent with the report in the course of their reporting are permitted without restrictions. We ask for consideration of any picture credits. The rights of use of the material sent with the report are valid for an unlimited period of time.